On 20 November 2025, the European Commission officially their legislative proposal (“Proposal”) for the updates to the Sustainable Finance Disclosure Regulation (“SFDR”). In a significant departure from the current SFDR disclosure regime, the European Commission proposes a categorisation regime for funds in its place.

The timing remains uncertain but we expect the package of changes to SFDR (referred to as “SFDR 2.0”) to come into force at the earliest at the end of 2027 or in 2028.

We cover here the core features of the amendments proposed, including how it contrasts to last week’s leaked version which has been much reported on. Please see our note summarising the leaked proposal here.

Entity-level disclosures

The Proposal removes the entity-level disclosure obligation to publish remuneration disclosures and, for financial market participants with 500 employees or more (or others opting in), disclosures on the principal adverse impacts of their investment decisions with regards to sustainability factors. This is a move that will be welcomed by a significant portion of firms in scope of SFDR.

Product-level disclosures

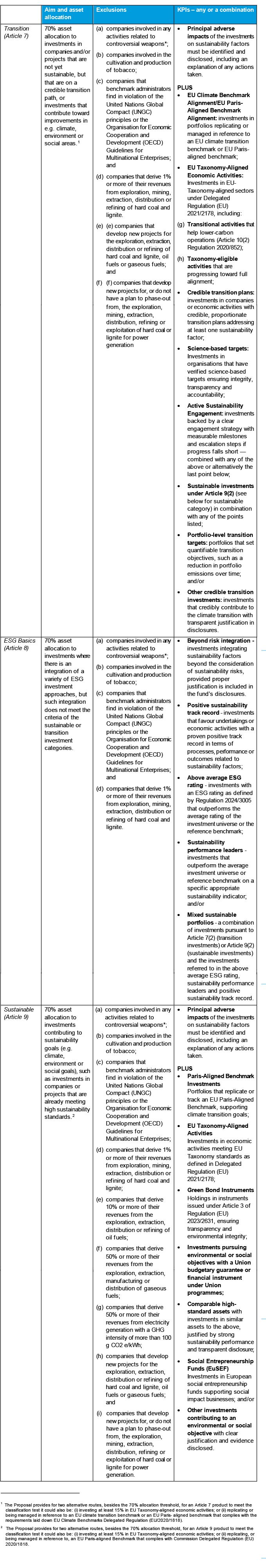

Three core categories are proposed with mandatory criteria, which the European Commission in their accompanying sets out functions on two main criteria (1): exclusions; and (2) positive contribution of a minimum portion 70% of the portfolio’s assets must follow an ESG strategy that matches the claims of the fund on binding basis.

*For the purposes of point (a) in the exclusions, controversial weapons shall mean controversial weapons as referred to in international treaties and conventions, United Nations principles and, where applicable, national legislation.

Phase-in

The 70% minimum asset allocation may be reached by the end of a disclosed phase-in period, provided the timeline is disclosed in the pre-contractual documents, which may be very useful for private markets managers. No maximum period is specified in the proposal.

Environmental objectives

Further updates to note are that “environmental objectives” are to be defined to track the Taxonomy Regulation and cover: climate change mitigation and climate change adaptation, the sustainable use and protection of water and marine resources, the transition to a circular economy, pollution prevention and control, and the protection and restoration of biodiversity and ecosystems.

Impact funds

A newly inserted Article 2 (26) establishes that “impact” can only be included in a fund name if it is a transition (Article 7) or sustainable (Article 9) fund, that has as its objective the generation of a pre-defined, positive and measurable social or environmental impact.

Funds with voluntary transparency on the integration of sustainability factors (New Article 6a)

Funds that are not categorized as Article 7 (Transition), Article 8 (ESG Basics) or Article 9 (Sustainable) products may still include, in their pre-contractual disclosure, information on whether and how the financial product considers sustainability factors beyond the consideration of sustainability risks. However, there are certain limitations that must be observed in relation to sustainability-related information, including that the information should not constitute claims within the meaning of the Article 7 (Transition), Article 8 (ESG Basics) and Article 9 (Sustainable) products, so that investors are not misled into believing that the fund is categorized under these Articles.

Article 6a further sets out that sustainability-related information should not be a central element of the pre-contractual disclosure, which is limited to less than 10% of the volume occupied by the presentation of the financial product’s investment strategy, as well as being neutral and secondary to the presentation of the fund’s characteristics in terms of breadth and positioning within the document.

There is also an obligation to provide investors with a description of the consideration of sustainability factors in the periodic report. The format of this reporting is not yet clear, but there is a reference to the annual reporting obligations under the existing Article 11 SFDR, so AIFMs would provide this reporting as part of the Article 22 AIFMD annual report.

Sustainability risks

The familiar requirement to disclose on how sustainability risks are integrated and their likely impact on the returns of the fund are retained under Article 6.

Disclosure templates

The mandatory templates for the pre-contractual and periodic disclosures are not included in this high-level regulation and will instead follow in regulatory technical standards. However, this legislation does set out that the pre-contractual disclosures will be a maximum of two pages and the periodic disclosures will be a maximum of one page. It is notable that the European Commission sets out in the accompanying Questions and Answers that “the revised framework foresees only limited details being left for implementing rules.” Therefore, when this regulatory text is agreed managers should be able to take informed decisions in relation to current or future funds and any categorization.

No opt out – with other restrictions now applicable to sustainability disclosures

In the leaked version of SFDR 2.0, we reported on an opt-out available for alternative investment funds marketed exclusively to professional investors. This has been dropped in its entirety. It remains open to speculation as to whether that was as a result of uncertainty surrounding any retail touchpoints in fund structures impacting the availability of the opt-out or alternatively was a step too far in deregulation.

Managers that decide not to classify their products under Article 7 (Transition), Article 8 (ESG Basics) or Article 9 (Sustainable) but still wish to describe their approach to sustainability will need to navigate Article 6a carefully. Article 13(3) There is a further restriction on the use of sustainability-related claims in fund names, which may be easy to marketing communications and fund names. Distinguishing between limited disclosure of integration and sustainability-related claims may be challenging; so further clarification in implementing rules would be helpful. However, as mentioned above, the European Commission indicates that only limited changes to delegated acts are expected, so this remains an area to watch.

Managers that choose not to classify their products under Article 7 (Transition), Article 8 (ESG Basics) or Article 9 (Sustainable) but still wish to describe their approach to sustainability will need to navigate Article 6a carefully, as set out above. While Article 6a allows for limited inclusion of sustainability-related information in “pre-contractual disclosures”, managers must also consider the restrictions under Article 13(3), which provides that financial market participants may not include sustainability-related claims in the names or “marketing communications” of financial products referred to in Article 6a.

This creates a fine balance: although some sustainability information may be permitted under Article 6a in pre-contractual disclosures, any reference that could be interpreted as a “sustainability-related claim” in marketing materials (or, less of an issue, product names) could fall foul of Article 13(3). Distinguishing between limited disclosure of sustainability integration under Article 6a and prohibited sustainability-related claims und Article 13(3) may prove challenging, particularly with the overarching aim to be clear, fair and not misleading across all documentation. Further clarification in the implementing standards or in European Commission guidance will be welcome on this.

Timeframe for SFDR 2.0

Timing remains uncertain but we expect SFDR 2.0 to come into force at the earliest at the end of 2027 or in 2028.

Next steps – for the European Commission and for asset managers

The European Commission proposal will now be submitted to European Parliament and Council of the European Union for their deliberation, which may trigger updates and amendments. Timing remains uncertain but we expect SFDR 2.0 to come into force at the earliest at the end of 2027 or in 2028.

Asset managers may want to get ahead with the following or alternatively wait for the final version:

- Map existing fund strategies against the new categories;

- Utilise investor relations team to establish investor expectations on categorization;

- Analyse the impact of exclusions against any Red State investor anti-boycott legislation (which can vary) as well as against portfolios; and

- Consider fund strategies that may not fit within the new categories while still integrating some sustainability factors, and how to navigate the potential tension between Articles 6a and 13(3).

For further information, please reach out to ukreg@proskauer.com.

.